How to Negotiate with Venture Capitalists

Silicon Valley Startup: Idea to IPO

Venture capital is the holy grail of funding for successful startups.

Startups that successfully close a venture capital funding round will have access not only to money but also experience, expertise and connections.

Silicon Valley has many success stories of venture-backed companies that went on to successful exits. However, there are as many stories of founders who lost their companies, exited too early or gave up too much to the venture capitalists.

If a startup is lucky enough to get a venture capital term sheet, how can the startup founder protect herself? What should be negotiated, and what should she expect?

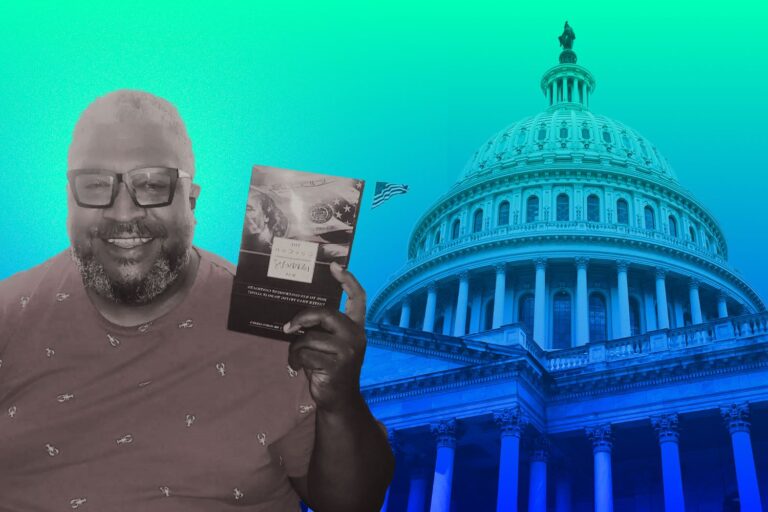

Join us as veteran Silicon Valley startup and venture capital attorney Roger Royse discusses how to negotiate with venture capitalists.

In this presentation, you will learn:

- How to do due diligence on a venture capitalist

- How to prepare your company for a venture capital financing

- How to best position yourself for a successful raise

- What terms to expect and what traps to avoid

- What terms are standard, and what terms you should never agree to

- What is a term sheet, and what can you expect to be in it

- How to protect yourself from overreaching investors

- How to position yourself for the future after the funding closes

- What to expect after the close….

And more!