Inside the Downfall – Uncovering the Pain Points Behind 23andMe’s Collapse

In the 2000s, 23andMe emerged as one of the most disruptive companies when it was able to provide DNA analysis at an affordable price with only a “spit.” During the course of its existence, 23andMe has been through a lot of hardships that formed the success of the company.

However, no one was ready for the unfolding dramas that have been making headlines since the last quarter of 2023. We all know that 23andMe’s future faces uncertainty, as the problems are not yet resolved. The hot question, “What happened to 23andMe?” will be answered in the following sections of this article. Before getting into the main course, let’s look at 23andMe and its amazing journey prior to this decline.

23andMe – The Journey to Bring Down the Cost of DNA Analysis

23andMe was founded in 2006 by Linda Avey, Anne Wojcicki, and Paul Cusenza with a groundbreaking idea: letting people learn about their ancestry and health risks through a simple saliva test.

Using a method called single nucleotide polymorphism genotyping, 23andMe could reveal family history and potential genetic issues based on just one sample. This was considered revolutionary in the late 2000s, earning 23andMe TIME magazine’s “Innovation of the Year” award in 2008 and setting a new standard for consumer genetics.

In its early days, 23andMe required substantial investment in research and development, and they were fortunate to have notable supporters from the beginning. Among them was Google co-founder Sergey Brin—Wojcicki’s fiancé at the time—who provided a $2.6 million loan to the company.

By the end of 2007, one of the founders had left 23andMe, leaving Linda Avey and Anne Wojcicki to lead the company. Avey brought scientific expertise, while Wojcicki contributed her knowledge of healthcare financing. Their combined skills helped the company raise $9 million, including $3.9 million from Google. Despite her connections, Wojcicki pushed the board to remove Avey, and the board agreed, believing Wojcicki’s connections and relationship with Sergey Brin would be more advantageous.

The company still needed more capital even with all those connections, as Wojcicki recognized that the cost of the testing kits had to be drastically reduced from the initial $1,000 launch price in 2006.

Thanks to ongoing research and a $52 million funding round led by Yuri Milner, 23andMe reduced the cost of their genetic testing to $99. In 2015, 23andMe quickly gained momentum, attracting hundreds of thousands of customers through positive social media reviews and extensive advertising.

The tests generated significant revenue and valuable data, prompting 23andMe to invest in drug development in 2015. By 2018, they partnered with GlaxoSmithKline, securing a $300 million investment. GSK renewed the partnership in 2022 with an additional $50 million investment. The collaboration led to the development of at least 50 candidate drugs and the launch of their first co-directed clinical trial in 2020.

As demand grew, 23andMe went public in 2021 through a merger with Richard Branson’s SPAC, initially valued at $3.5 billion. The company’s valuation at $6 billion after being listed on NASDAQ.

Look at their total money raised, company valuation, and the big names backing the company. One might think that this company has to be good with all those resources. That’s a common perception before things took a turn.

Going Down in Flames – The Unfolding Reasons Behind 23andMe Decline

Since then, the company has lost most of its value and now risks being delisted from NASDAQ as its share price has dropped below a dollar. To avoid delisting, 23andMe has been struggling with multiple rounds of layoffs, declining sales, and growing uncertainty about its future. Several factors are contributing to the challenges 23andMe is facing. Let’s begin by examining its business model.

The Business Model that Can’t Generate Enough Profitability

Despite pouring in massive investments, 23andMe still hasn’t cracked the code on profitability. Their business model offers little room for repeat business: once customers buy a DNA kit and get their results, the revenue stops there. Without a way to keep customers coming back, long-term growth remains elusive.

Rolfe Winkle, WSJ Reporter stated, “When you’re running a business, you typically want to have a product that consumers have to buy again and again. But with 23andMe, the key problem with their business is that you only really need to take the test one time.”

For most users, the genetic insights from 23andMe provide limited immediate healthcare value, which makes it difficult for the company to generate ongoing revenue. The profits from DNA kit sales barely make a dent in covering corporate expenses.

In the fiscal year ending March 31, 2024, 23andMe brought in $220 million in revenue and $99 million in gross profit, but with $781 million in operating expenses, the company reported a $680 million operating loss. This includes a $352 million goodwill impairment, yet even without it, they still lost over $300 million. To turn things around, 23andMe will need either a significant boost in revenue or major cuts to its spending.

Over the years, 23andMe has tried multiple strategies to improve its financial performance, but none have succeeded. In 2010, they launched a subscription service that promised ongoing DNA updates based on new medical research. However, it didn’t gain traction and was discontinued within two years. In 2020, they introduced a new subscription, 23andMe+, offering annual access to additional reports for $70. Yet, this service also fell short of making a meaningful impact on their financials.

Wojcicki’s ambitions for 23andMe went well beyond just subscription models; she aimed to harness the wealth of customer data for pioneering medical research. A key part of her vision was to compile a large genetic dataset from 23andMe’s users, allowing researchers to explore the connections between genetic variations and specific health conditions. By analyzing the genetic and health information of millions of customers, the company sought to identify patterns that could reveal potential therapies, leading to new treatments or prevention strategies for various health issues.

However, developing new drug therapies is a notoriously challenging and costly process. As mentioned above, 23andMe invests about $100 million each year into these endeavors, yet it has yet to successfully develop and bring any drug to market.

Series of Controversies that Ruined the Company Reputation

Since its inception, 23andMe has countered a series of controversies which challenging its reputation and testing customer trust in a fast-evolving industry where privacy and ethics are paramount.

In 2013, the FDA ordered 23andMe to halt the marketing of its DNA kits due to violations of the federal Food, Drug, and Cosmetic Act. The issue stemmed from the company’s promotion of its tests as medical devices without the necessary approval. In 2010, the FDA had already indicated that these products would be classified as medical devices, but by 2013, extensive communications revealed that 23andMe had failed to comply with the requirements.

The agency was particularly concerned about the lack of adequate testing to ensure the accuracy of healthcare-related results, which posed serious public health risks. In response, 23andMe acknowledged its shortcomings in a letter to the FDA. Eventually, after addressing these concerns, the company secured approval in 2015 and was able to resume marketing its tests.

In 2023, 23andMe faced a significant data breach that compromised the personal information of millions of customers, which was later offered for sale on the black market. The breach specifically targeted individuals of Jewish and Asian descent, with hackers selling the data for prices between $1 and $10 per profile.

This incident severely damaged 23andMe’s reputation, as genetic and ancestry information is deeply personal, resulting in widespread outrage among users. In September 2024, the company agreed to pay $30 million to settle a class action lawsuit connected to the breach.

As a result of this incident, concerns have arisen regarding how 23andMe manages genetic information, particularly in light of the company’s uncertain financial future. Customers are anxious about the fate of their personal data if the company is sold or ceases operations.

Leadership Challenges – Unsuccessful Attempts to Manage Cash Burn

By 2020, 23andMe was running low on cash. To address this issue, they raised another round of equity, securing an additional $80 million, but this only extended their funding by a few quarters. At this point, the company had raised nearly a billion dollars over more than a decade, and venture capital firms were increasingly hesitant to invest further.

Fortunately, this situation coincided with the Fed stimulus-driven SPAC craze of early 2021. In June of that year, 23andMe went public by merging with one of Richard Branson’s SPACs. The stock jumped 35% right away as investors flocked to the hype, and the transaction ultimately brought in $600 million for 23andMe, providing Wojcicki with another three years of operating capital.

However, this cash influx was not a sustainable solution. 23andMe needed to significantly lower its cash burn rate before the funds were depleted. To achieve this, the company carried out multiple rounds of layoffs, letting go of hundreds of employees over the years.

They also closed their in-house drug discovery division, which had been a pivotal initiative aimed at capitalizing on their customers’ genetic and health data. In addition, they sought alternative revenue sources, including the introduction of a DNA-informed telehealth service.

Despite these efforts, by 2024, the company seemed to be on the verge of bankruptcy. According to its latest financial filing, 23andMe had only $170 million in cash on its balance sheet while burning through cash at an annual rate of $180 million.

To make matters worse, their typical lifeline of equity sales was no longer viable, as their market cap had fallen below $200 million. 23andMe’s value was now just a fraction of the multi-billion dollar valuations it had reached in earlier funding rounds. As a result, the company was hemorrhaging more money each year than it was worth on the market.

Facing increasing pressure, the board of directors at 23andMe formed a special committee of independent directors in March 2024 to explore options for the company’s future. Just three months later, Wojcicki made a formal proposal to take the company private at 40 cents per share. This amount was only 4% of the valuation when the company went public in 2021 and didn’t offer any extra value compared to the stock’s latest closing price.

In her buyout proposal, Wojcicki noted that she and her associates were “interested only in participating in a transaction to acquire the shares of the company that we do not currently own,” making it clear they weren’t interested in considering any other sale or merger options.

Wojcicki’s offer to take the company private without any premium, along with her threat to block other proposals, was clearly unfair and not in the best interest of the company or its shareholders. In response, the special committee quickly rejected her proposal and told her she had a short time to make a better offer that would benefit everyone.

While they looked for other ways to get the company back on solid ground, Wojcicki decided not to change her offer, knowing she could stop any other plans from moving forward with her voting power. Then, on September 17th, every board member except Wojcicki resigned, which sent shockwaves through the financial media and showed that confidence in her as CEO was seriously lacking.

With Wojcicki holding 49% of the voting shares, the board felt they had no choice but to consider her lowball offer to buy the company. In her public statement, Wojcicki emphasized her belief that the company would be better off as a private entity, arguing that it would help them avoid the “short-term pressures of the public markets.”

The Product is Not that Valuable to Customers

23andMe is striving to establish itself as a significant player in the healthcare sector, focusing on using genetic insights to empower individuals to make proactive and potentially life-saving health choices.

For example, if a person learns they have a high genetic risk for heart disease, 23andMe encourages them to speak with their doctor about preventive measures, consider how medications might influence their condition, adjust their diet accordingly, and incorporate this information into their overall health strategy.

To build this level of trust, the company has invested substantially in securing FDA approvals, making acquisitions, and launching various initiatives aimed at enhancing its credibility in the medical field.

Many customers appear to see 23andMe primarily as a fun and intriguing way to explore their genetic background, rather than a serious health tool prompting lifestyle changes. If more users treated it as a legitimate health resource, they might be more willing to pay a higher price for the test and consider subscribing to premium services.

Plus, there are valid concerns surrounding their offerings. While the health reports offer insights into genetic risks for various conditions, users often find the practical application of this information to be limited, with many discovering that the health insights don’t directly address their immediate healthcare needs.

Back in the 2000s, 23andMe was considered a disruptive force. However, nearly 20 years since its inception, the market has grown, and there are now many alternatives. If customers are only interested in learning about their ancestry, several other options are available to them.

What Does 23andMe Doing to Tackle the Problems?

23andMe announced on October 30, 2024, that it has regained compliance with Nasdaq requirements. Specifically, the company met the minimum closing bid price requirement under Nasdaq Listing Rule 5550(a)(2) and fulfilled the majority independent board and various board committee requirements outlined in Nasdaq Listing Rule 5605. As a result, 23andMe’s Class A common stock will remain listed on The Nasdaq Capital Market, trading under the symbol “ME.”

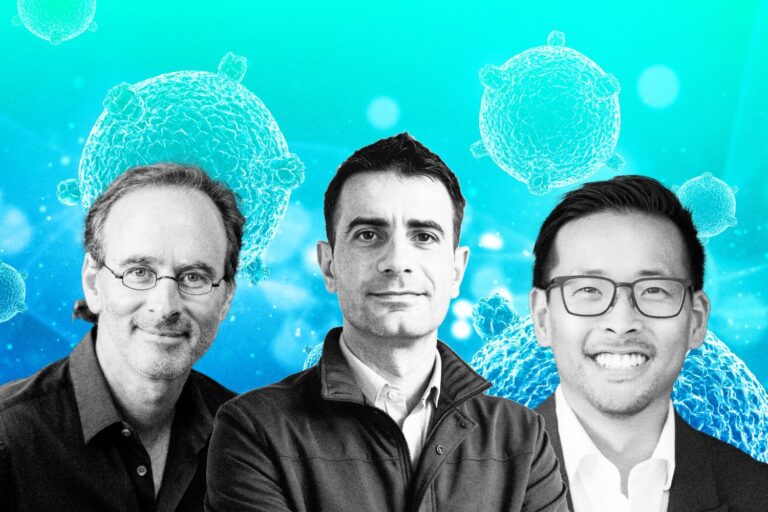

Also, On October 29, 2024, 23andMe appointed three experienced executives—Andre Fernandez, Jim Frankola, and Mark Jensen—as independent members of its Board of Directors, effective October 28. These new board members will also join the Board’s Audit and Compensation Committees, with Mr. Fernandez leading the Audit Committee and Mr. Jensen leading the Compensation Committee and serving as Lead Independent Director.

With these additions, the Board now includes the three independent directors alongside Anne Wojcicki, 23andMe’s CEO, Co-Founder, and Chair.

Mr. Jensen shared that the new directors are eager to collaborate with Anne Wojcicki and the leadership team, saying, “23andMe has a great brand, and the Company remains firmly committed to its mission of helping people access, understand, and benefit from the human genome. We’re ready to work with urgency to put the Company on a path toward long-term success.”

Despite several initiatives aimed at revitalizing the company, many people view its future with uncertainty.