Will Glassdoor Succeed Stepping Squarely into LinkedIn’s Career Networking Market?

As a professional network, LinkedIn can feel a bit like Facebook or Google these days — the giant that utterly dominates the market. But perhaps it should be looking over its shoulder.

Glassdoor, one of the US’s three largest job sites, has big ambitions which include stepping squarely into LinkedIn’s career networking market. For now, LinkedIn and Glassdoor are seen as complementary cousins. Glassdoor allows people to review their employers in the same way that TripAdvisor users review hotels. Many of Glassdoor’s visitors are also members of LinkedIn.

Employment Branding Platforms: LinkedIn Vs. Glassdoor

Companies recognize the power of employment branding when it comes to telling their story, influencing job seekers, and winning the war on talent. To stay relevant, employers today require a strong online presence across multiple channels to promote their brand and advertise their jobs to interested candidates researching them.

LinkedIn: The Largest Professional Networking Site

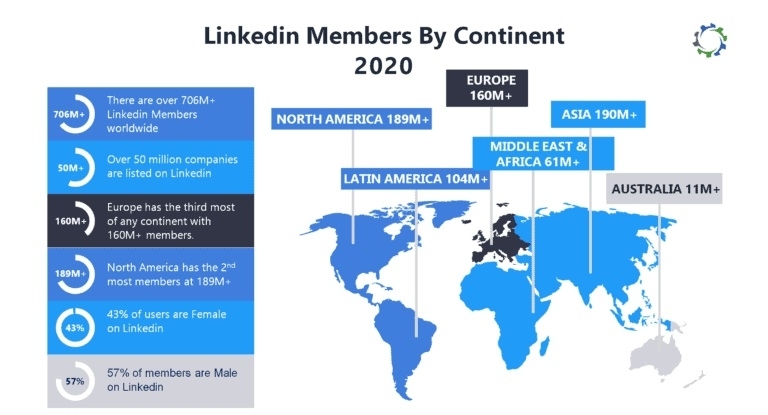

As of October 2020, the world’s largest professional social network has over 706 million users worldwide, including 170 million in the United States. Almost 75% of people who have recently changed jobs used LinkedIn to inform their career decision. With the most extensive professional profiles combined and its use of intelligent targeting, LinkedIn is an incredibly compelling tool to reach out to not just active, but passive candidates as a dominant employer.

LinkedIn’s main features:

- Job adverts distributed by LinkedIn’s algorithm

- The ‘Recruiter’ search function in the world’s biggest database

- Company page features to highlight employer brand

Microsoft successfully closed its $26 billion deal for LinkedIn in 2016, making it the largest acquisition in the tech company’s history. Bolstering their respective markets, LinkedIn has accelerated their growth by integrating Microsoft’s premiere features (Microsoft Outlook and Office 365).

With acquisitions of Lynda.com and SlideShare, LinkedIn is not only a professional networking site for millions of users, but also emerging as a career development platform. Also, with the inclusion of the LinkedIn posts, a lot of professional content is being generated by their large user base which plays a key role in retention and growth of unique user visits globally. However, there is a big BUT here…

When an individual looks to change jobs or wants to know about a potential employer’s culture, leadership, compensation, benefits etc., where do you think he/she goes to as the first resource other than personal connections?

No, not LinkedIn. Glassdoor for sure!

Glassdoor: The Ultimate “Shop Window” for Employees

Glassdoor gives an honest insight about what it’s like to interview and work at your company. With information on salaries, working conditions and interview experiences, it’s no doubt that Glassdoor is an essential platform to master. As an evaluation tool, it is a direct reflection of the quality and value your organization brings to its employees and candidates.

Glassdoor’s main features:

- Job adverts scraped from your company website

- Employer branding functions to benchmark against competitors

- Review highlighting

Many people think of Glassdoor as the website where you can go to check out a potential employer or find out what a company might pay. But the job reviews and salary intelligence site is also the second-biggest job listing site in the country.

How Glassdoor Prepared to Take Clear Aim at LinkedIn

Robert Hohman – co-founder and CEO at Glassdoor, explains that “a company might find someone using LinkedIn Recruiter and try to convince them to come and work for that company.” That person, Mr. Hohman says, will probably then go to Glassdoor to understand what it would be like to work for the company wooing them.

“We compete for recruiting dollars,” he says, adding that “in the US, as big as LinkedIn is, we are substantially larger when it comes to people researching companies.”

But would Glassdoor consider competing head on with LinkedIn by publishing personal profiles? Hohman’s answer makes it sound likely.

“It’s an option that’s open to us, yes,” he says. “We’re in a very good position. We think that people would share information with us that they might not share with a service like LinkedIn.”

Glassdoor already hosts 10m reviews on half a million companies and has 30m members. With a whiff of mischief, he adds: “It’s going to be very interesting. I promise you that.”

Stephen Waddington, editor of Share This: The Social Media Handbook for PR Professionals, says Glassdoor still feels more single-purpose than LinkedIn. But he adds it is a platform that people “have started taking very seriously in 12 months”.

“I think of us sort of as cousins. We’re related, but very different. The kind of highly transparent, gritty, real community that we have on Glassdoor is very, very different from what’s on LinkedIn or really on any other service – this kind of ability to see what’s really going on. And the result, we know now, is highly informed candidates and a higher quality, more informed candidate who’s applying to a company. So, we’re just different.” – Robert Hohman

Meanwhile, Helen Poitevin, an analyst at Gartner, says Glassdoor could come forward with a solution that competes with LinkedIn, noting that its challenge would be “balancing anonymity [of the reviewers] with people marketing themselves”. However, she believes it would take time to catch up with the substantial size of LinkedIn’s network of 706m professionals. LinkedIn was unavailable for comment.

“People would share information with us they might not share with a service like LinkedIn.”

– Robert Hohman, CEO at Glassdoor

Glassdoor has come far in a relatively short time. It was founded in 2007 by Expedia veterans Rich Barton, Tim Besse, and Robert Hohman. In the US, it is competing with Monster for second place behind LinkedIn.

Then there is mobile. “Job-seeking and applying via phone is something that is broken in our industry, so we’ll continue to invest heavily in that — it’s a big one.” This could have significant implications for growth in less developed countries where the primary means of internet access is via smartphones.

The other opportunity is to further exploit the company’s rich data. “There are many, many more layers of information,” says Mr. Hohman.

“For instance, you may be interested in sets of leaders [other than the chief executive] — if you’re going to work at a multinational company, the quality of the local leaders in the country you live in may be far more important to you than the main board,” he adds. “You’ll see us continue to pull the layers of the onion back in terms of what it’s like to work at a company.”

The salient question for LinkedIn is whether this more granular data about company managers will be extended to details of the jobs and career paths of the broader workforce. If yes, then an interesting battle is about to begin.

Choosing M&A Instead of IPO

In 2018, Glassdoor was acquired for $1.2 billion by the Japanese firm Recruit Holdings, which also owns the biggest jobs site, Indeed.

While some analysts expressed surprise by the $1.2 billion valuation, others weren’t surprised to see Glassdoor get acquired, despite earlier rumblings about an IPO. Both Facebook and Google have been getting into the business of job listings, Microsoft bought LinkedIn in 2016, and Randstad announced it was acquiring Monster Worldwide that same year.

“The fear, if you’re not a big player, is one of those other people is going to squash you, and the only way you’ll be able to compete is to pull together a bunch of other assets,” said Brian Kropp, who leads the HR consulting practice at CEB, which is owned by Gartner.

Hohman said he has always been open to either going public or an acquisition, but the acquisition by Recruit “immediately gives us scale” and speeds up its international presence. Also, he said, “I think Internet verticals inevitably consolidate.”

Over the past decade or so, companies have increasingly used the phrase “employment brand” to describe their image among job candidates and potential employees. Employers, increasingly reliant on talented employees in a knowledge economy, have had to do more to attract the right people. But what started as a wonky HR buzzword has become a powerful tool that has now nearly merged in importance with companies’ brand image with consumers, as people increasingly want to know how the companies they buy from treat their workers.

“There are plenty of companies we talk to where the CEO is acutely aware of their rating on Glassdoor,” Kropp said.

Some analysts said that in doing so, Glassdoor has essentially created a market, one where employers may feel they need to pay Glassdoor for those enhanced web pages and employer branding services to put their best foot forward. An article in The New Yorker about Glassdoor quotes the author of a book about online participation calling it “gentle extortion.” Hohman bristles at that description, saying they let any employer respond to any employee’s review or accusation at no cost.

“I think transparency is an inexorable force in the world right now, and we’ve always felt like this was going to happen no matter what,” Hohman said. “We wanted to do it in a way that was responsible, that was fair.” He also said companies that are customers do not have any way of influencing the comments on Glassdoor’s site, and that the company takes many steps to prevent PR efforts by employers to game campaigns for positive reviews.

Analysts say the $1.2 billion price tag for Glassdoor reflects a company that sits at the nexus of a number of trends: A tight labor market where many workers have their pick of jobs and employers have to work harder to attract them. A growing demand by recruiters and HR departments in an era of big data to back up their decisions with metrics. And a technological and cultural zeitgeist where an appetite for transparency and accountability have only grown more powerful.

“Now Recruit Holdings owns two of the biggest job sites as it prepares to take on other giants in the new battle for online job supremacy,” said Chris Russell, a recruiting technology and job site consultant with RecTech Media in Trumbull, Conn. He explained that companies like Recruit Holdings are concerned about Google (Google for Jobs) and Microsoft (LinkedIn) controlling online recruiting. “Recruit wants to defend their turf and expand it, thus guaranteeing a place in the hiring cycle.”

But There Must Be Reasons Why LinkedIn Has No Serious Rivals Yet

With millions of highly skilled employees on LinkedIn, the professional networking site is an essential tool for corporate and agency recruiters alike. The ‘serious network’ has been a dominant player since it first launched in 2003 and no new platforms have seriously challenged its market position, at least for now.

Cornering the Market

LinkedIn did not become the “Facebook for business” by accident. The network was first launched by founder Reid Hoffman on May 5, 2003. Within the first month, it gained 4,500 users.

LinkedIn was successful early on at driving high quality professionals to their site. Hoffman deliberately seeded the product with power users, as he knew that creating an aspirational brand was key to going mainstream. The network would have failed if there hadn’t been a major adoption of influencers in 2003.

LinkedIn also crucially deployed an Outlook style contact uploader to allow it to go viral. By doing so they managed to increase their user base far quicker than any competitor. Even today, no other brand has invested in this area despite the distribution benefits you get from Outlook compared to webmail.

Empire Building

During its formative years, LinkedIn deferred any content related revenue or engagement strategy until its growth path was established. Despite substantially increasing its B2C content output since then, most employees consider LinkedIn a low maintenance network. It doesn’t require constant engagement or day-to-day management.

Most LinkedIn’s users have no tangible need to register anywhere else. The account creation process is lengthy and once completed, the average LinkedIn user has little incentive to job hunt on smaller platforms. As LinkedIn grows, more people use the exact same platform, and using any other professional networking website becomes less attractive.

For individuals, it’s a place to network. For recruiters, it’s a platform to post jobs and source talent. LinkedIn today remains the ultimate tool for anyone looking to make professional connections or find employment.

“At the End of the Day, It’s Not Really Much of an Issue…”

LinkedIn and Glassdoor do differ in their offerings and are considered as two separate resources from a user standpoint. In fact, it may not make a lot of sense to compare the two organizations due to the differences in the offerings. But it makes significant strategic sense for a complete professional platform to combine the offerings of both the organizations.

“At the end of the day, of course, we are competing for recruiting dollars. So yes, we do butt heads a little bit there, but the way we help companies recruit is just so different that it hasn’t really been much of an issue.” – Robert Hohman

It’s hard to say from the side-by-side comparison as to which product has a better prospect to emerge on top in the long run. Glassdoor’s database of 10 million company reviews, salary info, interview process and culture insights is on a head-on collision with LinkedIn’s 706-million-user base who have provided end-to-end insights into their career history.

The key to long term dominance of one of these players will depend on its ability to replicate the missing piece of its product from the other and succeed in that. Will LinkedIn be able to generate the amount of intelligence Glassdoor has on organizations? Or will Glassdoor be able to convince their growing user base to accept them as an end-to-end professional networking site?

LinkedIn has the upper hand in terms of the user base and the ability to invest significantly without having to sweat. As of now, Glassdoor is nowhere near LinkedIn’s financial books. But at the same time, Glassdoor’s database of insights and intelligence into organizations is not an easy one to replicate for LinkedIn.

Definitely, an interesting and exciting segment to keep a close watch on. Whatever is going to be the outcome, customers will be the winner for sure!